Nonprofit payment processing

Offer payment flexibility for your supporters and benefit from simple online payment management for your nonprofit organization.

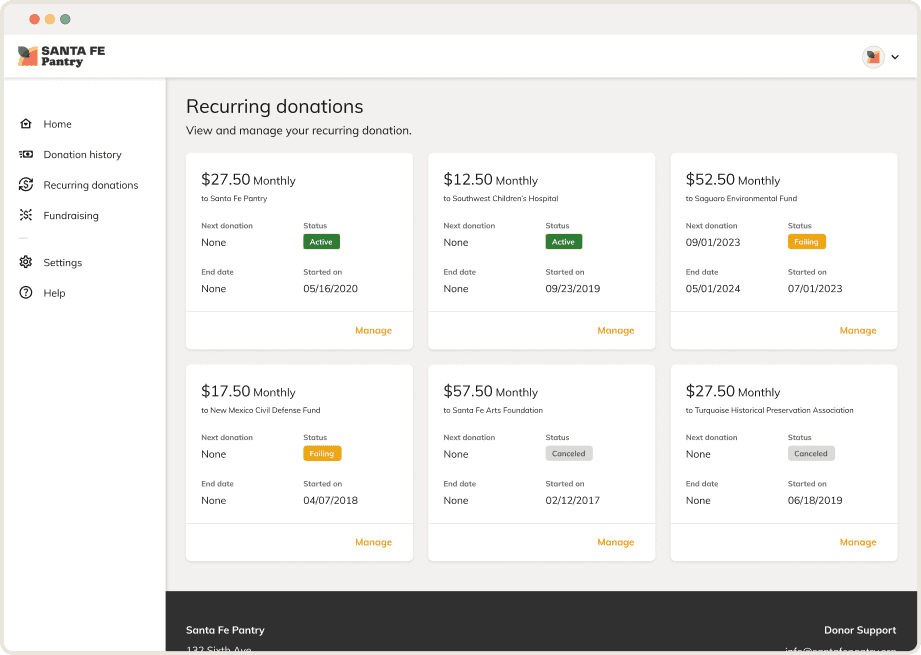

Provide donors the tools to give more, more often

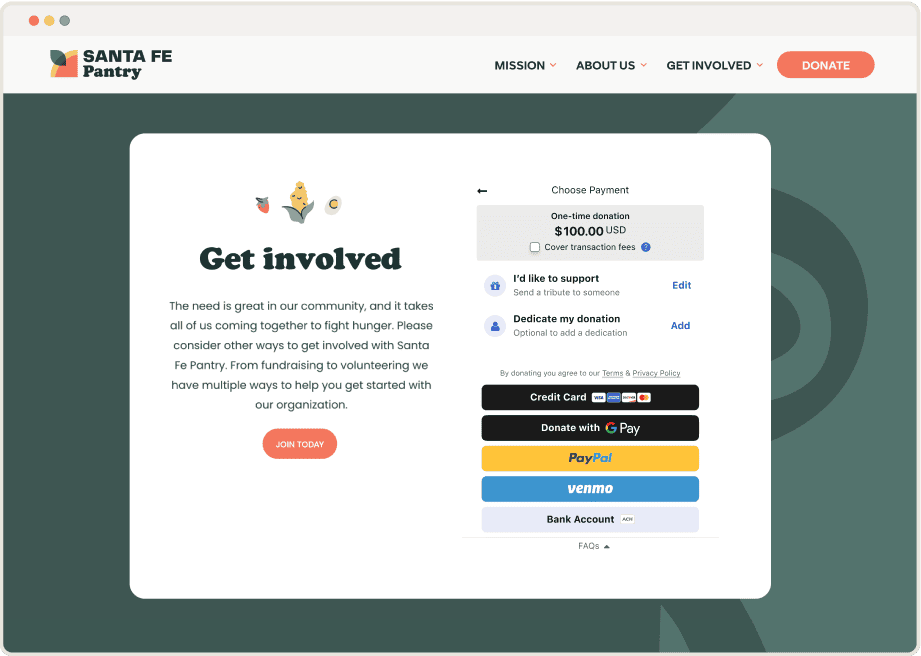

Streamline the donation process and raise more by offering flexible payment options across any online fundraising campaign.

Easy to switch

With no upgrade fee, industry-competitive rates, and a simple activation process, you can upgrade your online payment solution in three simple steps.

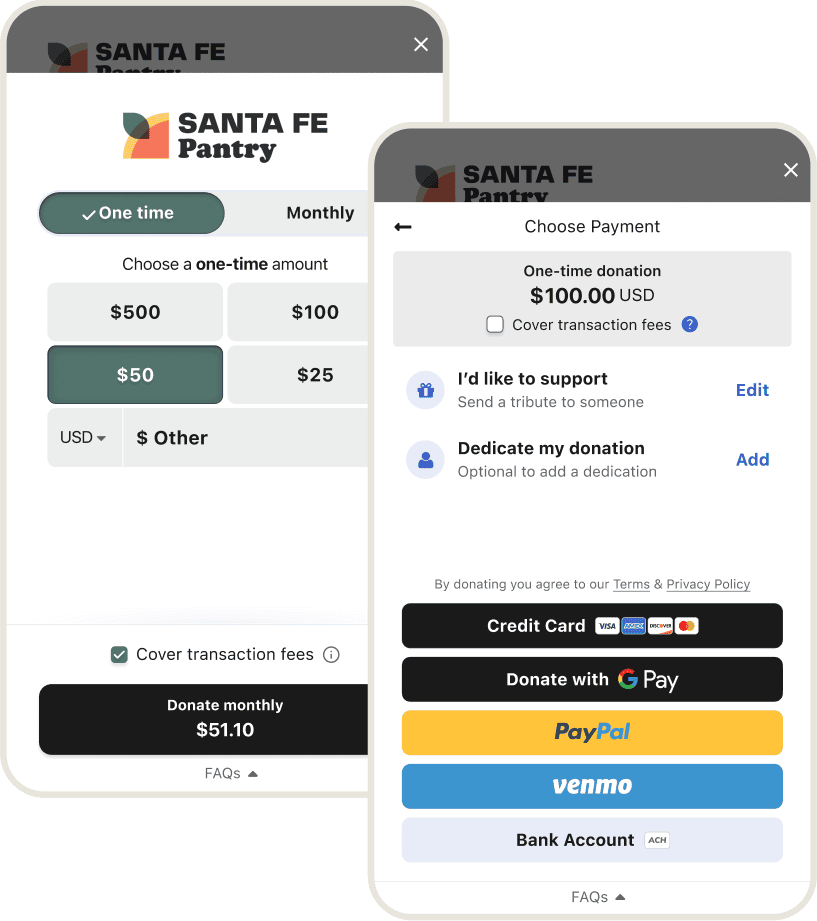

Flexible options

Empower supporters to choose their desired payment method, donation size, and frequency.

Secure transactions

We maintain a safe environment for donor data with Level 1 PCI compliance and SSL Security, built on Amazon Web Services. We never store credit card or debit card data.

Exceed expectations with modern transactions

- Improve acceptance rates with credit card (powered by Stripe) and ACH payments, backed by AI-enabled auto-retry logic

- Reduce steps in the checkout process with digital wallets, including Apple Pay and Google Pay

- Leverage modern payment methods like PayPal, Venmo, and crypto on your campaigns and embedded online donation modal forms

- Boost conversion rates by more than 2 points by activating Venmo on Classy Pay*

* Classy Platform Data

- Prevent the impact of an expired or lost credit card with Classy Pay’s automatic credit card updater

- Drive the lifetime value of your donors with recurring gifts on Classy Pay across all payment options

- Maximize the potential of recurring gifts, which are 29% higher on average with ACH than those made with a credit card*

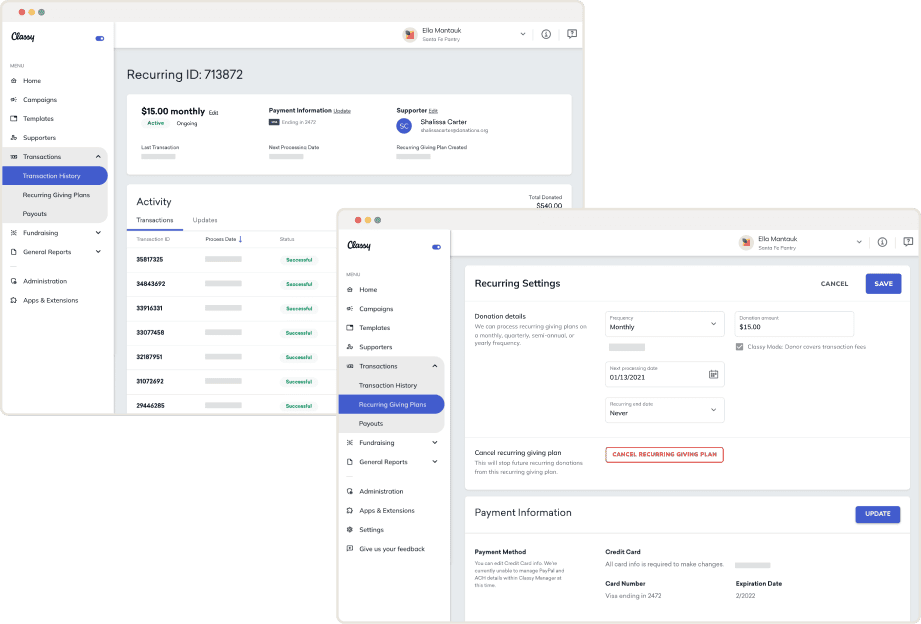

- Nurture contacts and personalize communications using the online donation data within Classy Manager

* Classy Platform Data

- Secure transactions and reduce fraud by 25% on average with industry-leading fraud protection powered by Stripe Radar

- Have the peace of mind for you and your donors

- Rely on Classy Pay, built on the most reputable and innovative processors

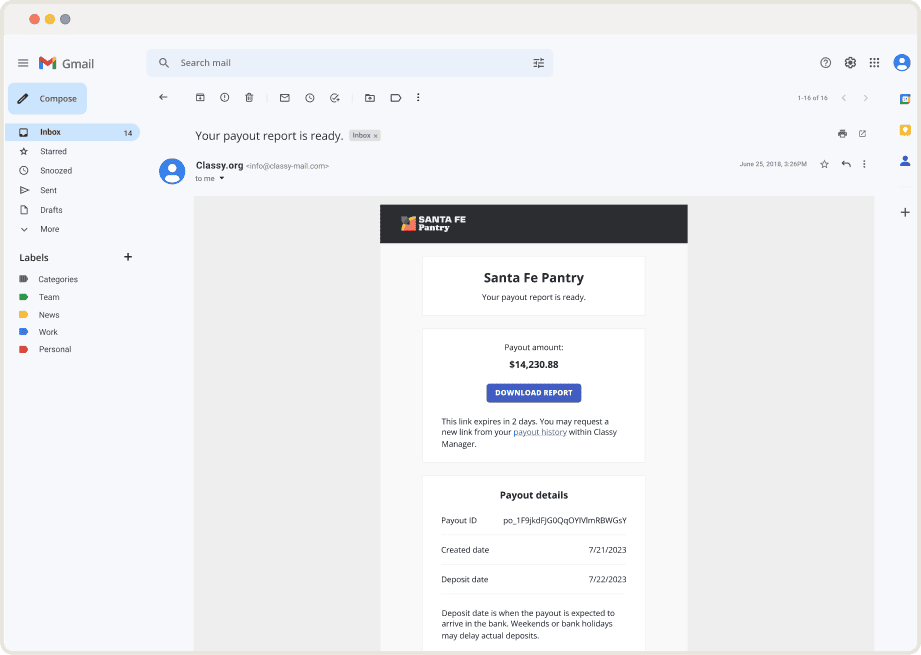

- Access your funds faster with daily cash-out

- Easily reconcile all payment types and deposits and manage all transaction data in your Classy account

- Reduce chargebacks with Stripe Radar to save your team time and resources

FAQs

Why do nonprofits need a donation payment processor?

Nonprofits need a payment processor to enable them to fundraise online, but accepting donations is just one part of the equation. Nonprofits have a diverse constituency base, and not every segment wants to donate the same way. It’s critical to offer a variety of payment options to drive conversion and acquire new donors. We believe this choice shouldn’t come at the cost of complexity.

Classy pay offers the payment options donors want. We provide transaction reporting, payout reporting, and processor management all from within Classy Manager so all of your program management can happen alongside the rest of your fundraising efforts.

Does Classy Pay reduce fraud?

Yes, Classy’s multi-tiered security stack is designed to protect your organization and its data. An example of this is Stripe, one of Classy Pay’s payment processing partners, which has been shown to reduce fraudulent activity by up to 25% with Stripe Radar.

Is there a credit card processing or transaction fee?

There are processing fees associated with each of Classy Pay’s processing partners. Effective 9/1 credit card transactions start at 2.4% + $0.30 and PayPal/Venmo transactions start at 2.5% + $0.30.

What security and scalability measures does Classy have in place?

Classy builds security into the foundation of all our products and services.

Our comprehensive approach includes governance, continuous scanning and monitoring, and robust infrastructure. Our dedicated team receives regular training to stay updated with the latest security practices and threats.

We’re a PCI DDS Level 1 service provider that utilizes industry best practices like the OWASP Top 10. We use Cloudflare for protection and partner with Stripe, PayPal, and Coinbase for secure payments.

Learn more about our security and scalability here.

See Classy Pay in action

Envision how your organization can raise more with our donation payment processing technology.